A Great Opportunity for Donors and the Community

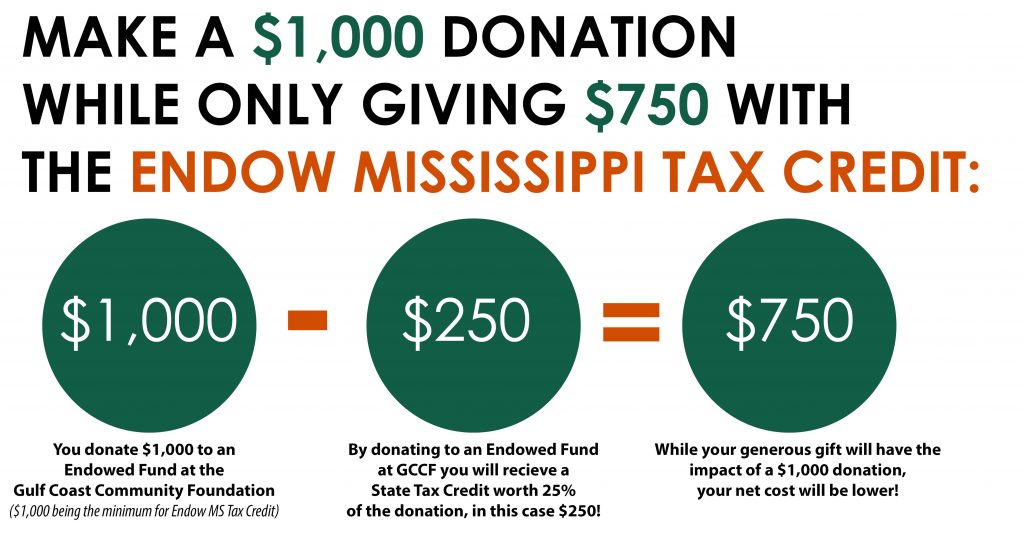

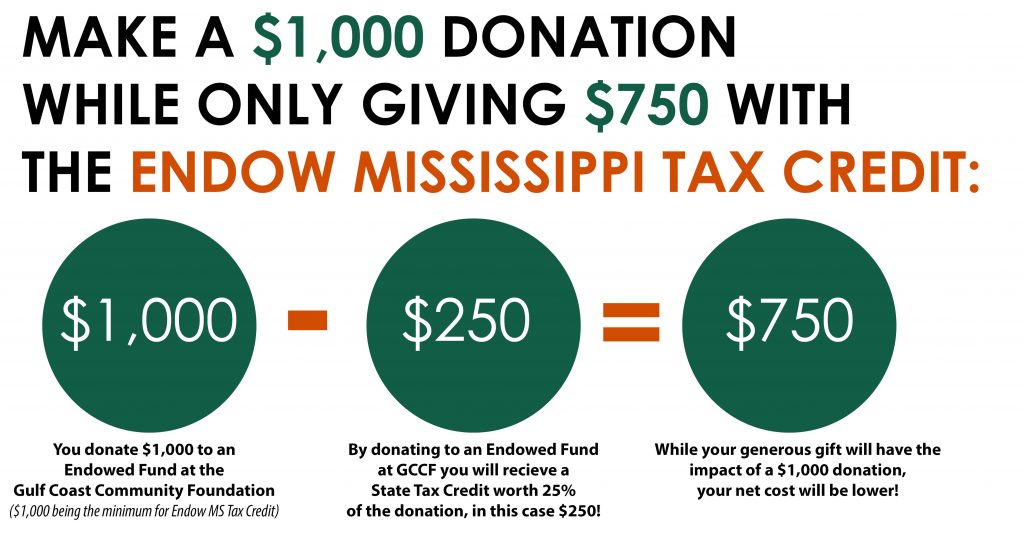

In early 2019, Mississippi legislators enacted the Endow Mississippi Program, which provides a 25% state tax credit for contributions to endowed funds at qualified Mississippi community foundations, such as the Gulf Coast Community Foundation.

For 30 years, the Gulf Coast Community Foundation, has striven to “Turn Donor Passion into Meaningful Change”. The Community Foundation offers a wide variety of endowed funds to support charitable causes or organizations. So, whether you are passionate about education, animal welfare or community enrichment, there are plenty of options to match your passion. We can even help you establish a new fund.

Endow MS Tax Credit:

• You must apply for the tax credit prior to making a charitable gift.

• Gifts must be made to a permanent endowment fund at a qualified community foundation.

• The tax credit is 25% of the charitable contribution (Example: a $10,000 contribution would be followed by a by a $2,500 credit and $7,500 of that contribution can still be claimed as an itemized charitable deduction on your state taxes).

• Tax credits are available to for contributions between $1,000 & $200,000 per year. The total amount of credits available state-wide is $500,000 per year and will be awarded on a first-come, first-serve basis.Tax credits will become available beginning January 1 of each year.

To apply for the Endow Mississippi Tax Credit or for more information, contact Rodger Wilder (RWilder@mgccf.org) or Lauren Williams (LWilliams@mgccf.org). OR call 228-897-4841.